From Global Market Insights

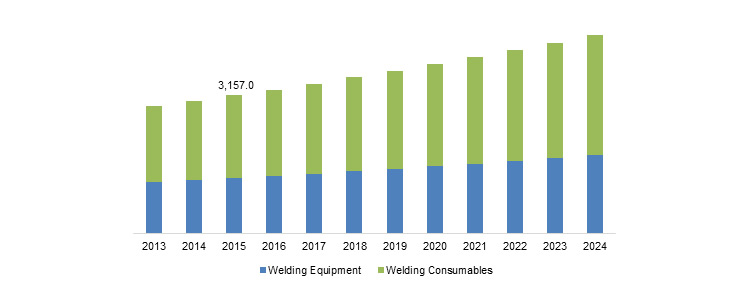

The market for welding equipment and consumables is forecast to rise by a compound annual growth rate of more than 4 percent in each of the next six years, surpassing $25 billion by 2024—up from $19 billion in 2016. Welding equipment and consumables are used extensively in almost all major industries, including building, construction, aerospace, oil and gas, and automotive. Thousands of products find applications in each of these industries, creating demand for these items on a large scale.

Growth is being driven by a rising middle class in India, China and Brazil.

Geographically, Asia Pacific accounts for a notable share of the welding equipment and consumables market, which will grow at a significant rate and consume over 40 percent of all such products sold and distributed by 2024. The increasing population and rising income levels in these emerging economies, as well as rapid urbanization, creates a need for better infrastructure and demand for new homes and automobiles.

Vehicle sales in India and China were valued at over $30 billion in 2016, and the automotive industry will continue to propel the welding equipment and consumables market during the next seven years.

Construction activity in the Asia-Pacific region will further boost demand. The region held a 45 percent share of global construction spending in 2016. Moreover, infrastructure and transportation development are expected to further spur the welding equipment and consumables market.

U.S. Welding Equipment & Consumables Market Size, by Product

2013–2024 (USD Mn)

Industrialization and the creation of infrastructure and communities requires energy, so oil and gas demand will follow, and the increasing explorations will trickle down to welding equipment and consumables.

With close to a fifth of global market share, the North American consumption will move up by 4 percent annually in the forecast timespan, due to rising oil and shale gas extraction activities.

Based on product, the arc equipment segment currently holds—and will continue to hold— a major share in the global industry. Arc equipment is generally used to join base metals, and the segment generated about $3 billion in 2016. Oxy-fuel held 10 percent of the welding equipment and consumables market that year and will continue to grow at over 4.5 percent through 2024. One of the oldest forms of welding, oxy-fuel equipment finds maximum application in home-based shops and metal-based artwork. On the consumables side, the flux-cored wires segment accounted for around $900 million in 2016.

Risk factors

A couple of factors may restrain the burgeoning market, however. One of those is emerging technologies, such as friction stir welding, which is a joining process of two facing workpieces in the solid state by using a non-consumable tool. The process is carried out without melting the material. It is gaining popularity in the shipbuilding, aerospace and transportation industries and may have a negative effect on the welding supply market.

Another factor that could hinder growth is the possibility of hazards due to poor working conditions in small and mid-sized enterprises. Without stringent safety measures, the welding process leads to considerable environmental and health hazards due to the release of toxic gases such as nitric oxide, carbon monoxide, ozone and nitrogen dioxide. When released in the air, these gases cause contamination and may also result in pulmonary infection or respiratory illness to unprotected workers.

Going forward, the competitive landscape within the welding equipment and consumables market will remain intense, with companies relying on new technology development, along with mergers and acquisitions, to maintain their market positions.

Global Market Insights, Selbyville, Delaware, publishes over 200 market research reports per year. Its research professionals track key industries, identifying crucial developments, unmet needs and potential growth opportunities. Access the full Welding Equipment & Consumables Market report >.